Once a DC Cum Invoice is generated, it may or may not need to be authorized.

Read more...

Read more...|

You are here : Sales > Dispatch > DC Cum Invoices Entry DC Cum Invoices Entry |

This option allows to create DC Cum Invoice for Items.

IMMS allows to create Invoices for -

Sale of Scrap Items

IMMS provides the facility to create Invoices for partial quantity of delivered Item, thereby allowing to create multiple Invoices against the same Document. The pending quantity of the Item that remains is taken care of while creating subsequent Invoices.

The same screen also records information related to Dispatch.

Being a tightly integrated software, IMMS automatically updates the stock and finance once a Delivery Cum Invoice is saved.

|

Once a DC Cum Invoice is generated, it may or may not need to be authorized.

Authorization of DC Cum Invoice is a flag driven option. Therefore its availability depends upon the setting of the 'Authorization Required' flag through Document Control Master option (

Read more... Read more... |

After creating and Authorizing a DC Cum Invoice, it can neither be changed nor deleted but can be Canceled.

The screen has been divided into 5 tabs - Basic Details, Item Details, Total Amount Details, Dispatch Details, Caption Detail, Attachment and ARE Details to save different information. You can click on the respective tab to read more about it.

After creating an Invoice, it can NOT be deleted but can be edited.

Specify the Source for Invoice as follows -

Select one of the sources against which Invoice is made from the given popup as follows -

Select this option if Invoice has to be made against OAFs created for Sales Items through Sales Module.

Select this option if Invoice has to be made against OAFs created for Service Items through Sales Module.

Select this option if Invoice has to be made against Vendor Rejection Notes created through Quality Control And Assurance Module.

Select this option if Invoice has to be against sale of Scrap Item.

This option will be displayed as selected if Invoice is made against Sales Items, Service Items or Scrap Items. Otherwise it will not be selected.

This option will be displayed as selected if Invoice is made against Purchase Rejections. Otherwise it will not be selected.

Year:

Denotes the year of DC Cum Invoice.

While 'Adding', current financial year is displayed by default. It can not be changed.

In case of 'Search' and 'Delete', current financial year is displayed by default but it can be changed.

Group Code:

Denotes the Group of DC Cum Invoice.

Please note that the Group which has been specified as default for the selected financial year (

- Sales & Service,

- Purchase Rejection) through Document Control Master option in Administrator Toolswill be displayed automatically.

You can change it by pressing <F5> key to access a list of already defined DC Cum Invoice Groups for the entered Year though Document Control Master option in Administrator Tools Module. Select your desired Group from the list by scrolling down to it and pressing <ENTER>. Alternatively you can also enter the Group Code.

Site Code:

Denotes the Site of DC Cum Invoice.

By default the Site if any specified with the selected DC Cum Invoice Group (

- Sales & Service,

- Purchase Rejection) will be displayed automatically.

Press <F5> key to access a list of already defined Sites. Select your desired Site from the list by scrolling down to it and pressing <ENTER>. Alternatively you can also enter the Site Code.

Number:

(Type : Alphanumeric, Length : 6)

Denotes the Number of DC Cum Invoice.

While 'Adding', DC Cum Invoice Number is either generated automatically or entered manually by the user.

Generation of DC Cum Invoice Number is a flag driven option and depends upon the setting of flag 'Auto Number Generate Required' (

- Sales & Service,

- Purchase Rejection) through Document Control Master option in Administrator Tools Module.

Click here to read more about the flag...

In case of 'Edit' and 'Search', press <F5> key to access a list of DC Cum Invoice Numbers already created for the selected Invoice Of, Year, Group Code and Site Code. Select your desired Number from the list by scrolling down to it and pressing <ENTER>. Alternatively you can also enter the Invoice Number. Press <ENTER> or click on 'Show' icon. All the other relevant data is displayed automatically.

Date:

Specifies the Date of Invoice.

While 'Adding', today's date will be displayed by default. You can change it but it should not be before the Current Period Start Date and should not be later than the Current Period End Date. Neither can it be later than today's date. Press <ENTER>.

In case of 'Search'and 'Edit', Date will be displayed automatically for the selected Invoice Number. You can NOT change it in 'Edit' mode.

Place of Supply:

(Type : Alphanumeric, Length : 50)

While 'Adding', City and State of the selected Shipment Code of the selected Customer as entered through Customer Shipment Master option will be displayed by default. It can be changed. Enter the Place of Supply for the Invoice.

In case of 'Search'and 'Edit', Place of Supply will be displayed for the selected Invoice Number. You can change it in 'Edit' mode.

Customer / Vendor Code:

Denotes the Customer/Vendor for whom Invoice is made.

While 'Adding' a new Invoice -

In case of Invoice is for Sales/Service/Scrap, press <F5> key to access a list of already existing Customers defined through Customer Master option. Select your desired Customer from the list by scrolling down to it and pressing <ENTER>. Alternatively you can also enter the Customer Code.

In case of Invoice is for 'Purchase Rejection', press <F5> key to access a list of already existing Vendors defined through Vendor Master option of Purchase Module. Select your desired Vendor from the list by scrolling down to it and pressing <ENTER>. Alternatively you can also enter the Vendor Code. Please note that only those Vendors will be accepted/displayed against which Rejection Notes already exist.

In case of 'Edit' and 'Search', Customer Code will be displayed automatically as per the selected Invoice Year + Invoice Group Code + Invoice Site Code + Invoice Number. You can NOT change it in 'Edit' mode.

Customer/Vendor Name:

Name of the selected Customer/Vendor will be displayed automatically.

Curr. Code:

Automatically displays the Currency Code of the selected Customer/Vendor as specified through Customer Master option or Vendor Master option of Purchase Module. You can NOT change it.

Excisable

Please note that if the Invoice is being generated on or after 1st of July 2017, this field will be displayed as selected by default and will remain disabled.

While 'Adding', select this option by clicking on it if the Invoice is for Excisable Items.

In 'Search' and 'Edit' modes, this option will be displayed as selected if the selected Invoice is for Excisable Items. You can NOT change it in 'Edit' mode.

Non Excisable

Please note that if the Invoice is being generated on or after 1st of July 2017, this field will remain disabled. You can not select it.

While 'Adding', select this option by clicking on it if the Invoice is for non Excisable Items.

In 'Search' and 'Edit' modes, this option will be displayed as selected if the selected Invoice is for non- Excisable Items. You can NOT change it in 'Edit' mode.

Shipment Code:

Denotes the Shipment Code for the Invoice.

While 'Adding' a new Invoice -

In case Invoice is for 'Sales' or 'Service', press <F5> key to access a list of all the Shipment Codes existing in the Open Sales Orders for the selected Customer (provided Allocation has already been done against it). Select your desired Shipment from the list by scrolling down to it and pressing <ENTER>. Alternatively you can also enter the Shipment Code. Press <ENTER>.

In case Invoice is for 'Purchase Rejection' or 'Scrap', the Shipment Code will remain disabled. The Vendor Code will be displayed instead.

In case of 'Search' and 'Edit' modes, Shipment Code will be displayed automatically as per the selected Invoice Number. You can NOT change it in 'Edit' mode.

City Code / Name:

City Code and Name of the selected Customer/Vendor will be displayed automatically as per entered through Customer Shipment Master option or Vendor Master option of Purchase Module. You can NOT change it in 'Edit' mode.

CST No:

CST Number of the selected Customer/Vendor will be displayed automatically as per entered through Customer Shipment Master option or Vendor Master option of Purchase Module. You can NOT change it in 'Edit' mode.

GST No:

GST Number of the selected Customer/Vendor will be displayed automatically as per entered through Customer Shipment Master option or Vendor Master option of Purchase Module. You can NOT change it in 'Edit' mode.

Generate ARE

Please note that this option will NOT be displayed in case of 'Scrap Sales'.

Specifies whether the ARE document is associated with the Invoice or not.

While 'Adding', select this option by clicking on the small white box if it is an Export Invoice. ARE Details can be entered only if this flag is selected.

In case of 'Search'and 'Edit', this option will automatically be displayed as selected or un-selected as per the selected Invoice Number.

Next, a grid will be displayed. The availability of this grid depends upon the source of Invoice chosen by you. The grid is as follows -

While 'Adding' a new Invoice -

In case the Invoice is for 'Sale' or 'Service' items, the grid will be populated and displayed with the details of Order Acknowledgment Forms belonging to the selected Customer as follows -

Please note that only those OAFs will be displayed that belong to the selected Site and still have some amount pending for Invoice.

Select or un-select a particular OAF by pressing <SPACEBAR> on its row. Only the selected OAFs will be considered for the Invoice.

In case the Invoice is for 'Purchase Rejections', the grid will be populated and displayed with all the existing authorized Purchase Rejection Notes created for the selected Vendor through Vendor Rejection Note option of Quality Control & Assurance Module. The grid is as follows -

Please note that only those Rejection Numbers will be displayed that belong to the selected Site and still have some amount pending for Invoice.

Select or un-select a particular Rejection Number by pressing <SPACEBAR> on its row. Only the selected Rejection Numbers will be considered for the Invoice.

In case the Invoice is for 'Scrap Sales', the grid will remain disabled.

Denotes the Rate Structure Code for the Invoice.

While 'Adding' a new Invoice -

In case Invoice is for 'Sale' and 'Service', press <F5> key to access a list of all the Rate Structures mentioned for the Items in their respective Internal Orders belonging to the selected OAF. Select your desired Rate Structure from the list by scrolling down to it and pressing <ENTER>. Alternatively you can also enter the Rate Structure Code. Press <ENTER>.

In case the Invoice is for 'Purchase Rejection' or 'Scrap Sales', press <F5> key to access a list of all the Rate Structures defined through the Rate Structure Master option. Select your desired Rate Structure from the list by scrolling down to it and pressing <ENTER>. Alternatively you can also enter the Rate Structure Code. Press <ENTER>.

Please note that in case -

In case of 'Search' and 'Edit', Rate Structure Code for the selected Invoice Number will be displayed automatically. You can NOT change it in 'Edit' mode.

A grid will be populated and displayed as per your selection as follows -

While 'Adding' a new Invoice -

In case Invoice is for 'Sale' and 'Service', this grid will display all the Sales Items belonging to the selected OAFs that have the same Rate Structure and Shipment Code as selected in Basic Details tab. Click here to read about the fields...

In case the Invoice is for 'Purchase Rejection', this grid will display all the Items belonging to the selected Purchase Rejections that have the same Rate Structure as selected in Basic Details tab. Click here to read about the fields...

In case the Invoice is for 'Scrap Sales', this grid will be displayed empty. Click here to read about the fields...

In case of 'Search' and 'Edit', this grid will be populated with all the Items belonging to the selected Invoice Number. You can change ONLY the Invoice Quantity.

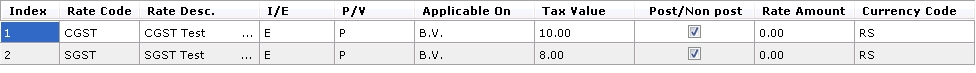

While 'Adding', this grid will be populated with Rate Codes belonging to the Rate Structure selected in the Basic Details tab.

In case of 'Search' and 'Edit', Rate Structure of the selected Invoice Number will be displayed automatically. It can NOT be changed in 'Edit' mode.

Field Description of the grid -

Index:

Automatically generated sequence number.

Rate Code:

Automatically displays the Rate Code belonging to the Rate Structure for your reference.

Rate Desc:

Automatically displays the Description of the Rate Code belonging to the Rate Structure for your reference.

I/E:

Automatically displays whether the selected Rate Code is Included or Excluded as specified through Tax Rate Master - Entry option for your reference. It can NOT be changed.

P/V:

Automatically displays whether the value of the selected Rate Code is in Value or Percentage as specified through Tax Rate Master - Entry option for your reference. It can NOT be changed.

Applicable On:

Automatically displays the Rate Codes on which this particular Rate Code is applicable.

Tax Value:

Automatically displays the Value of the selected Rate Code as specified through Tax Rate Master - Entry option for your reference.

Post/Non Post:

Automatically displays whether the selected Rate Code is Postable or Non Postable in Sales as specified through Tax Rate Master - Entry option for your reference. If it is Postable, the box will be displayed as checked otherwise it will be displayed empty.

Rate Amount:

In case of 'Percentage', the Rate Amount field in the grid is calculated automatically as % (entered in Tax Value field) of Total Amount. In case of 'Value', the entered amount of tax is displayed.

Currency Code:

Automatically displays the Currency of the selected Rate Code as specified through Tax Rate Master - Entry option for your reference.

While 'Adding', all the fields will be displayed blank.

In case of 'Search' and 'Edit', values in the following fields will be displayed automatically as per the selected Invoice Number. You can change some of them in 'Edit' mode.

Total Actual Amount:

Shows the Total Actual Amount of Invoice in Customer's currency. You can not change it.

Total Invoice Amount:

Shows the Total Amount of Invoice in Customer's currency. You can not change it.

Please note that if the flag 'Allow to Round off Total Invoice Value' is set as 'Yes' through Sales Policy of Administrator Tools Module, IMMS will automatically show the rounded off Invoice Amount. If the flag is 'No', the Amount will NOT be rounded off.

Round Off Amount:

(Type : Numeric, Length : 2.2)

Enter the number up to which the 'Total Amount with Taxes' should be rounded off to.

Total Amount With Taxes:

Shows the Total Amount of Invoice including the tax amount in Customer's currency. You can not change it.

Please note that this section will be displayed only if the DC Cum Invoice is in Foreign Currency. It displays Amounts in Domestic Currency.

Total Actual Amount:

Automatically calculates and displays the Total Actual Amount in Domestic Currency as 'Total Actual Amount' * Exchange Rate. It can NOT be changed.

Total Invoice Amount:

Automatically calculates and displays the Total Invoice Amount in Domestic Currency as 'Total Invoice Amount' * Exchange Rate. It can NOT be changed.

Total Amount With Taxes:

Automatically calculates and displays the Total Amount With Taxes in Domestic Currency as 'Total Amount With Taxes' * Exchange Rate. It can NOT be changed.

Displays the Exchange Rate that has to be considered while converting amounts from Foreign Currency to Domestic Currency. You can not change it in 'Edit' mode.

At the Time of Last OAF

Select this option by clicking on it if you want to consider the Exchange Rate that was mentioned in the last OAF.

Current

Select this option by clicking on it if you want to consider the current Exchange Rate (selling rate)specified through Exchange Rate Master Entry option of Administrator Tools Module.

Other

Select this option by clicking on it if you want to consider Exchange Rate other than the above two.

Exchange Rate:

Enter the Exchange Rate. Press <ENTER>.

Denotes the mode through which the Documents related to the Invoice will be sent.

Press <F5> key to access a list of existing Mode of Dispatches defined through Codes Master Entry (Code Type = 'MOD') option of Administrator Tools Module. Select your desired Mode from the list by scrolling down to it and pressing <ENTER>. Alternatively you can also enter the Mode Code.

Description of the selected Mode Code will be displayed automatically.

Denotes the date on which the goods have to be dispatched.

While 'Adding', today's date is displayed by default. You can change it but it should either be same as Invoice Date or one day more than Invoice Date. Press <ENTER>.

In case of 'Search' and 'Edit', Goods Removal Date will be displayed automatically as per the selected Invoice Number. You can change it in 'Edit' mode.

Denotes the time on which the Excisable Items were removed.

While 'Adding', System time is displayed by default. You can change it. Press <ENTER>.

In case of 'Search' and 'Edit', Goods Removal Time will be displayed automatically as per the selected Invoice Number. You can change it in 'Edit' mode.

Denotes whether the Invoice is for Export Supply or not.

While 'Adding', if the selected Customer's or Vendor's Country is same as the current Site's Country, 'No' will be displayed automatically in this field. You can change it to 'Yes' by clicking on the given popup. In case the Countries are NOT the same, 'Yes' will be displayed automatically in this field and it can NOT be changed.

In case of 'Search' and 'Edit', the value of this field will be displayed automatically as per the selected Invoice Number. You can change it in 'Edit' mode.

Specify the Financial Details related to the Invoice as follows -

Customer Code:

Displays the selected Customer Code for whom Invoice is created.

Customer Name:

Displays the name of the selected Customer Code for whom Invoice is created.

Account Group:

Denotes the Debit Account Group for the Invoice that has to be Debited.

By default the Account Group specified for the selected Customer through Customer Master option will be displayed. You can change it.

Press <F5> key to access a list of Sundry Debtors defined through Accounts Master Entry option of Finance Module that have Group Type = 'Debtors'. Select your desired Account from the list by scrolling down to it and pressing <ENTER>. Alternatively you can also enter the Account Code. Press <ENTER>. The system will check whether the right Code has been entered or not.

Account Group Name:

Description of the selected Account Group will be displayed automatically.

Payment Period:

Denotes the period of payment.

While 'Adding', press <F5> key to access a list of Payment Periods defined through Codes Master - Entry (Code Type = 'PPPRD') option of Administrator Tools Module. Select your desired Payment Period from the list by scrolling down to it and pressing <ENTER>. Alternatively you can also enter the Payment Period Code. Press <ENTER>.

In case of 'Search' and 'Edit', Payment Period will be displayed automatically as per the selected Invoice Number. You can change it in 'Edit' mode

Payment Description:

Description of the selected Payment Period will be displayed automatically.

Sales Book Code:

Specify the Sales Book for the Invoice.

Press <F5> key to access a list of Sales Books defined through Book Master Maintenance option of Finance Module that have Book Type = 'Sales (Non-Excise)' OR 'Sales (Excise)' OR 'Sales (Services)' depending upon the Type of Invoice. Select your desired Book from the list by scrolling down to it and pressing <ENTER>. Alternatively you can also enter the Book Code. Press <ENTER>. The system will check whether the right Code has been entered or not. Description of the selected Sales Book will be displayed automatically.

Select A/C Grp Code:

Automatically displays the Account Group associated with the selected Sales Book. You can not change it here.

Sales A/C Group:

Displays the description of the Sales Account Group Code.

Sales Account Code:

Specify the Account Code under the selected Account Group that has to be credited.

Press <F5> key to access a list of Accounts belonging to the selected Account Group. Please recall that Accounts are defined through Accounts Master Entry option of Finance Module. Select your desired Account from the list by scrolling down to it and pressing <ENTER>. Alternatively you can also enter the Account Code. Press <ENTER>. The system will check whether the right Account Code has been entered or not.

Sales Account Desc:

Description of the Account is displayed automatically as per the Account Code.

Whether reverse charge applicable?

Denotes whether the reverse charge is applicable for the invoice or not.

While 'Adding', select either 'Yes' or 'No' from the given popup by selecting the desired option.

In case of 'Search' and 'Edit', value of this field will be displayed automatically as per the selected Invoice Number. You can change it in 'Edit' mode.

While 'Adding' an Invoice, all the following fields will be displayed blank.

In case of 'Search' and 'Edit', values in all the following fields will be displayed automatically as per the selected Invoice Number. They can be changed.

Stores Transport related details as follows -

Mode of Dispatch:

Denotes the mode by which the Dispatch will be done.

While 'Adding' an Invoice, Mode of Dispatch of the selected Sales Order Number will be displayed by default. In case there are multiple Orders chosen, the Mode of Dispatch of the first Sales Order will be displayed. You can change it.

In case of 'Search' and 'Edit', Mode of Dispatch of the selected Invoice Number will be displayed automatically. You can change it in 'Edit' mode.

To change, press <F5> key to access a list of Modes of Dispatches defined through Codes Master - Entry (Code Type = 'MOD') option of Administrator Tools Module. Select your desired Mode from the list by scrolling down to it and pressing <ENTER>. Alternatively you can also enter the Mode Code. Press <ENTER>. Description of the selected Mode will be displayed automatically.

Transporter's Code:

Denotes the Transporter of the Dispatch.

Press <F5> key to access a list of Transporters defined through Codes Master - Entry (Code Type = 'TR') option of Administrator Tools Module. Select your desired Transporter from the list by scrolling down to it and pressing <ENTER>. Alternatively you can also enter the Transporter Code. Press <ENTER>. Description of the selected Transporter will be displayed automatically.

Transport Address:

(Type : Alphanumeric, Length : 40 + 40)

Enter the full postal address of the Transporter.

LR/Docket No - Date:

(Type : Alphanumeric, Length : 15)

Enter the Lorry Receipt or Docket Number and Date of the dispatch.

Road Permit No - Date:

(Type : Alphanumeric, Length : 15)

Enter the Road Permit Number and Date of the transporter.

Please note that in case -

- the flag 'Road Permit Received?' for the selected Internal Orders is set as 'Yes'

through Sales Order Receipt Entry option and the flag 'Allow to make Invoice without Road Permit' is set as 'No'

through Sales Policy option of Administrator Tools Module, than it is compulsory to enter the Road Permit No. Otherwise IMMS will not allow to save the Delivery Challan.

- the flag 'Road Permit Received?' for the selected Internal Orders is set as 'Yes'

through Sales Order Receipt Entry option and the flag 'Allow to make Invoice without Road Permit' is set as 'Yes'

through Sales Policy option of Administrator Tools Module, than if the user has not entered the Road Permit No., IMMS will display an appropriate message informing the same but also allows the user to continue saving the Delivery Challan.

- for rest of the combinations, IMMS allows to save the Delivery Challan.

Vehicle No:

(Type : Alphanumeric, Length : 15)

Enter the Vehicle Number carrying the dispatch.

Net Weight:

(Type : Numeric, Length : 9.3)

Enter the Net Weight of the dispatch.

Net Weight UOM:

Denotes the Unit of Measurement of the Net Weight of dispatch. A list of all Unit of Measurements defined through Codes Master - Entry (Code Type = 'UM') option of Administrator Tools Module will be displayed in a popup. Select the desired UOM by clicking on it. If not applicable, select 'None'.

Gross Weight:

(Type : Numeric, Length : 9.3)

Enter the Gross Weight of the dispatch.

Gross Weight UOM:

Denotes the Unit of Measurement of the Gross Weight of dispatch. A list of all Unit of Measurements defined through Codes Master - Entry (Code Type = 'UM') option of Administrator Tools Module will be displayed in a popup. Select the desired UOM by clicking on it. If not applicable, select 'None'.

Packing List Print Facility:

Allows to attach a packing list available with the dispatch.

Click on button to open a window. Look for the file in its path and click on 'Open' button to select it. As a result, the name of the file will appear in this field. Click on 'Cancel' button to discard and go back to the field.

Port of Loading:

(Type : Alphanumeric, Length : 100)

Enter the Port of Loading for the dispatch.

Port of Discharge:

(Type : Alphanumeric, Length : 100)

Enter the Port of dispatch.

Remark:

Enter Remarks, if any related to the dispatch.

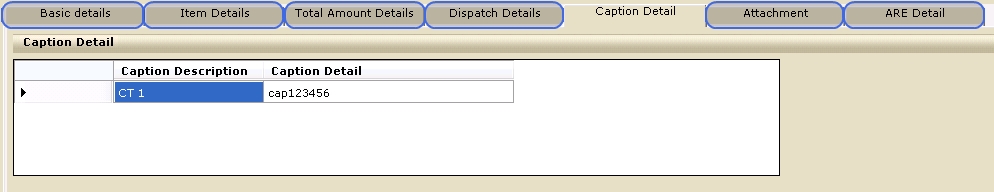

A list of all Statutory Captions that have been specified as Available for the combination of 'Invoice Entry' and currently logged-in Company through Statutory Number And Caption Availability option of Administrator Tools Module will be displayed in a grid as follows -

|

Scroll through the Captions. Press <ENTER> on the 'Caption Detail' field and enter the relevant data. |

Moreover if a particular Caption has been declared as 'Keep Mandatory' through Statutory and Other Caption Detail option of Administrator Tools Module, it becomes compulsory to enter its value. Otherwise IMMS will display an appropriate message while saving the GRN.

Moreover if a particular Caption has been declared as 'Keep Mandatory' through Statutory and Other Caption Detail option of Administrator Tools Module, it becomes compulsory to enter its value. Otherwise IMMS will display an appropriate message while saving the GRN.

A grid will be displayed as follows -

While 'Adding' a new DC Cum Invoice, this grid will be displayed empty.

In case of 'Edit' and 'Search' modes, a list of attached files is displayed. Double Click on the file name to view it. Click on 'Remove' button if you want to remove the file.

Click on 'Add' button to attach a new file as shown below -

Click on the file name after searching it from the right path.

Click on 'Ok' button to select the file or 'Cancel' button to discard.

Please note that the entry in this screen is enabled only if Generate ARE option is selected. Otherwise the fields will remain disabled.

While 'Adding', following fields will be displayed blank.

In case of 'Search' and 'Edit', values in the following fields will be displayed automatically as per the selected Invoice Number. You can change them in 'Edit' mode.

Specify the type of ARE Document for the Invoice.

ARE - 1

Select this option by clicking on it if ARE - 1 is associated with the Invoice.

ARE - 3

Select this option by clicking on it if ARE - 3 is associated with the Invoice.

Specify ARE Details as follows -

Group Code:

Denotes the Group Code of the ARE Number.

Please note that this field will be visible only if the Group Code of ARE1/ARE3 has been specified through Document Control Master

option of Administrator Tools Module. Otherwise this option will not be displayed at all.

Group Code of ARE1/ARE3 will be displayed automatically.

Site Code:

Denotes the Site Code of the ARE Number.

Please note that this field will be visible only if the Site Code of ARE1/ARE3 has been specified through Document Control Master

option of Administrator Tools Module. Otherwise this option will not be displayed at all.

Site Code of ARE1/ARE3 will be displayed automatically.

ARE Number:

(Type : Alphanumeric, Length : 6)

While 'Adding',

In case the flag 'Auto Number Generate Required' flag

for ARE1 or ARE3 is ticked through Document Control Master option of Administrator Tools Module, the system will automatically generate a unique ARE Number. The user will not be able to enter it.

In case the flag is NOT ticked, the system will allow the user to enter a unique ARE Number.

In case of 'Search' and 'Edit', ARE Number will be displayed automatically for the selected Invoice Number. You can NOT change it.

Transaction Date:

Enter the date of Transaction for the ARE Number.

Export Under:

(Type : Alphanumeric, Length : 50)

Enter under what the Export is being done as per the government norms.

Export By:

(Type : Alphanumeric, Length : 50)

Enter Export By.

Export Benefits:

(Type : Alphanumeric, Length : 50)

Enter the Benefits claimed under the Export as per the government norms.

Shipment Port:

(Type : Alphanumeric, Length : 50)

Enter the Port of Shipping for the Invoice.

Shipping Bill No:

(Type : Alphanumeric, Length : 50)

Enter the Shipping Bill Number for the Invoice.

Remarks:

(Type : Alphanumeric, Length : 50)

Enter Remarks if any, related to the ARE Document.

Bond No:

(Type : Alphanumeric, Length : 50)

Enter Bond Number if any, related to the ARE Document.

Once all the information has been entered related to the DC Cum Invoice, click on 'Save' icon to finally save it or 'Cancel' icon to discard. Click on 'Close' icon to go back to the main menu.