![]() Please note that IMMS allows

to 'Add' and 'Edit'

transactions belonging to current financial year only. Although you can view transactions belonging to any

existing financial year through 'View'

mode.

Please note that IMMS allows

to 'Add' and 'Edit'

transactions belonging to current financial year only. Although you can view transactions belonging to any

existing financial year through 'View'

mode.

Please note that you can NOT 'Edit' or 'Delete' an authorized Voucher.

Location:

Denotes the Site of the Bill Passing Voucher.

While 'Adding', the currently logged in Site will be displayed by default. You can change it. Click on the field to access a list of already defined Sites for the currently selected Company through Site Master option of Administrator Tools Module. Select your desired Site from the list by clicking on it. Alternatively you can also enter the Site Code.

Please note that only those Sites will be displayed/accepted for which the logged-in user has the rights to access.

In case of 'Edit', and 'View', Location is displayed automatically as per the selected record. It can NOT be changed.

Number:

(Type : Alphanumeric, Length : 6)

While 'Adding', Voucher Number is either generated automatically or entered manually by the user.

through Document Control Master option in Administrator Tools Module.

Click here to read more about the flag...

In case of 'Edit', and 'View', Location is displayed automatically as per the selected record. It can NOT be changed.

Voucher Date:

Specifies the Date of the Voucher.

While 'Adding' a new Bill Passing Voucher, today's date is displayed by default.

Click here to read more about the flag...

In case of 'Edit', and 'View' , Date is displayed automatically as per the selected Voucher Number. It can NOT be changed.

Currency:

Automatically displays the Currency of the selected Vendor specified through Vendor Master Entry option of Purchase Module.

Inter Branch/Inter Site

Denotes whether the Bill Passing transaction should be considered as Branch/Site transfer or not.

This option will automatically be displayed as 'On' if the selected Vendor has been declared as Branch/Site through Vendor Master Entry option of Purchase Module. Otherwise it will be displayed 'Off'. You can not change it.

While 'Adding',

click on ![]() button to continue further. As a result

you will be directed to the Transaction Details section to specify tax related information.

button to continue further. As a result

you will be directed to the Transaction Details section to specify tax related information.

In case of 'Edit', and 'View', you can directly click on the Transaction Details section.

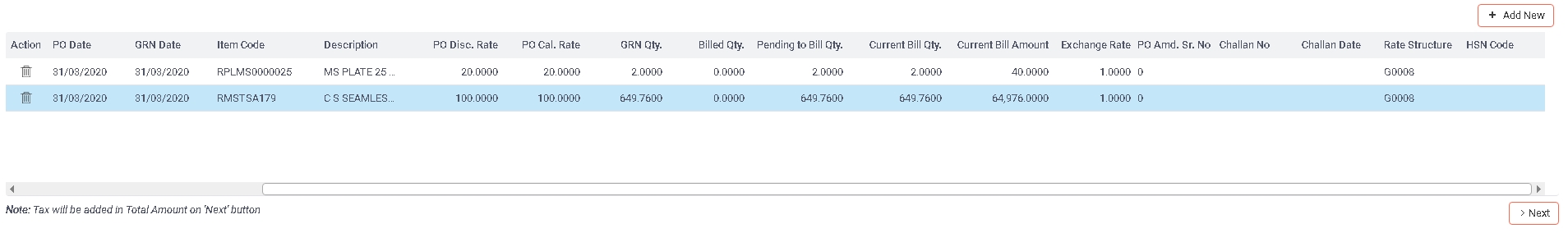

While 'Adding' a new Bill Passing entry, a blank grid will be displayed. You can start entering the details.

In case of 'Edit', and 'View', the grid will be automatically populated and displayed with Transaction Details belonging to the selected Voucher Number. You can NOT change any data in 'Edit' mode. Although you can add new detail.

Click on ![]() button to enter more transactions. As a result, a new row will

added in the end of the grid.

button to enter more transactions. As a result, a new row will

added in the end of the grid.

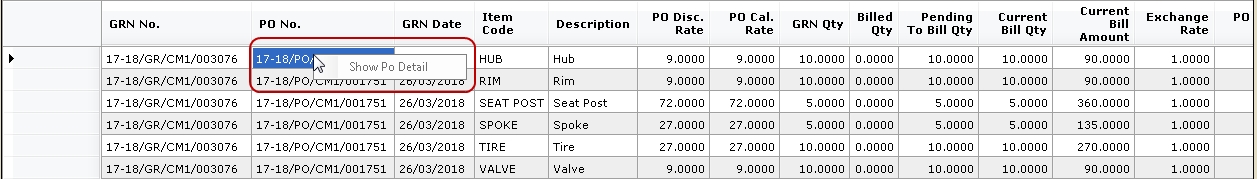

IMMS also provides facility to view the details of a particular Purchase Order. <RightClick> with mouse anywhere on the row of desired Purchase Order. As a result, following option will be displayed -

Click on button to view the details of that Purchase Order. Please note that you can not make any changes through this screen.

Field Description of the grid -

While 'Adding',

click on ![]() button to continue further. As a result

you will be directed to the Rate Structure Information section to specify tax related information.

button to continue further. As a result

you will be directed to the Rate Structure Information section to specify tax related information.

In case of 'Edit', and 'View', you can directly click on the Rate Structure Information section.

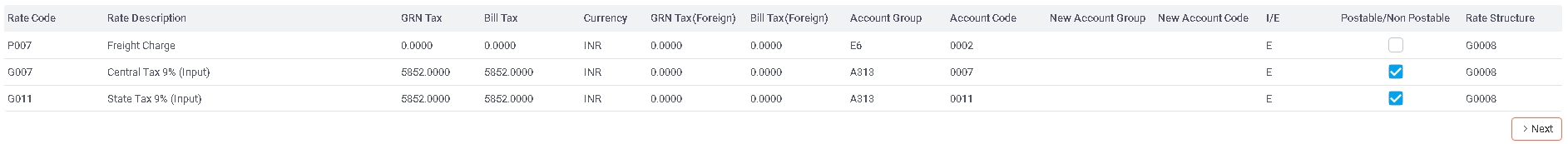

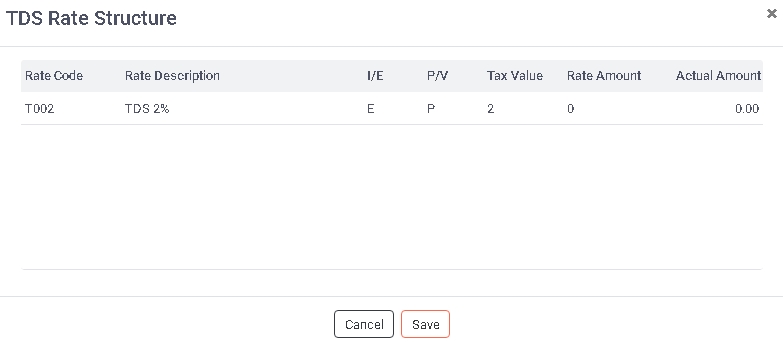

A grid will be automatically populated and displayed with the Rate Codes of the selected GRN's Rate Structure as follows -

Field Description of the grid -

Rate Code:

Displays the Rate Code of the Rate Structure. You can not add or change any Rate Code.

Rate Description:

Displays the description of the Rate Code.

GRN Tax:

Displays the amount of taxes as mentioned in the GRN. You can not change it.

Bill Tax:

(Type : Numeric, Length : 10.4)

In case of 'Adding' a new Bill Passing Entry, displays the amount of taxes as mentioned in the GRN by default. You can change it for the Bill.

In case of 'Edit', and 'View', Bill Tax is displayed as per the selected Bill Number. You can change it in 'Edit' mode..

Changing of Bill Amt is a flag driven option that depends on the setting of flag 'Allow Changing Taxes while doing Bill Passing?'

set through Finance Policy option in Administrator Tools Module. If the flag is set as 'On', IMMS will allow to change the Tax Amounts for the Bill. Further, the entered Bill Tax will be added to Total Amount if the Tax Type is 'Exclusive'. In case of 'Inclusive' Tax Type, Bill Tax will not be added to Total Amount. If the flag is set as 'Off', IMMS will NOT allow to change the amounts of taxes for the Bill resulting in the Tax Amounts for BILL to be same as Tax Amounts for GRN.

Account Group:

Automatically displays the Account Group of the Rate Code as specified through Tax Rate Master - Entry option of Purchase Module for your information. It can NOT be changed.

Account Code:

Automatically displays the Account Code of the Rate Code as specified through Tax Rate Master - Entry option of Purchase Module for your information. It can NOT be changed.

New Account Group:

IMMS allows to post the Postable Tax Amount at the time of Bill Passing to a particular control Account instead of 'Rate Difference Account' by linking that Postable Tax with the new Account.

But this is a flag driven facility which is available only when the flag 'Transfer Postable Tax Amount in New Account with changed Amount at the time of Bill Passing ?'

is selected as 'On' through Finance Policy option of Administrator Tools Module.

Automatically displays the new Account Group linked with the Rate Code as specified through Tax Rate Master - Entry option of Purchase Module for your information. It can NOT be changed.

New Account Code:

IMMS allows to post the Postable Tax Amount at the time of Bill Passing to a particular control Account instead of 'Rate Difference Account' by linking that Postable Tax with the new Account.

But this is a flag driven facility which is available only when the flag 'Transfer Postable Tax Amount in New Account with changed Amount at the time of Bill Passing ?'

is selected as 'On' through Finance Policy option of Administrator Tools Module.

Automatically displays the new Account Code linked with the Rate Code as specified through Tax Rate Master - Entry option of Purchase Module for your information. It can NOT be changed.

I/E:

Automatically displays whether the Rate Code is 'Inclusive' or 'Exclusive' as specified through Tax Rate Master - Entry option of Purchase Module for your information. It can NOT be changed.

Postable/NonPostable:

Automatically displays whether the Rate Code is Postable or Non Postable as specified through Tax Rate Master - Entry option of Purchase Module for your information. It can NOT be changed.

Automatically calculates and displays the Total Amount in Domestic Currency as -

sum of 'Bill Tax' + sum of 'Current Bill Amount'

While 'Adding',

click on ![]() button to continue further. As a result

you will be directed to the Advance/Retention/TDS section to specify tax related information.

button to continue further. As a result

you will be directed to the Advance/Retention/TDS section to specify tax related information.

In case of 'Edit', and 'View', you can directly click on the Advance/Retention/TDS section.

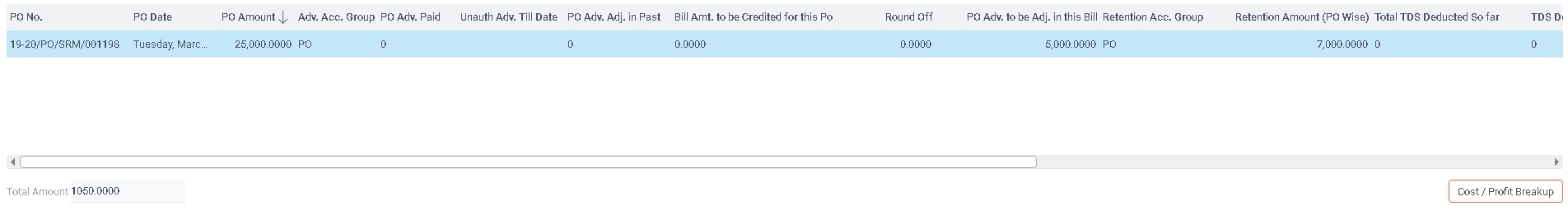

While 'Adding' a new Bill Passing Entry, a grid will be populated and displayed automatically. 'Bill Amount' (from 'Transaction Details' tab) for all the GRN Items belonging to each Cutting GRN/Purchase Order will be summed up and displayed in an individual row for that Cutting GRN/Purchase Order. So the gird will have one row for each Cutting GRN/Purchase Order and its other related details.

In case of 'Edit', and 'View', this grid will display data belonging to selected Voucher Number. When some changes are made in 'Transaction Details' tab through 'Edit' mode, this grid will automatically display the Cutting GRNs/Purchase Orders with their respective recalculated Bill Amount and other related details.

Apart from the Amount that has to be paid through this Bill, this grid also takes care of the following -

Field Description of the grid -

PO No:

Displays the Purchase Order Number for your information purpose.

Please note that in case the Bill is for 'Cutting GRN', this field will display the GRN No.

PO Date:

Displays the Date of Purchase Order for your information purpose.

Please note that in case the Bill is for 'Cutting GRN', this field will display the GRN Date.

PO Amount:

Displays the total amount of Purchase Order for your information purpose. This includes all the GRN existing against it.

Please note that in case the Bill is for 'Cutting GRN', this field will display the total amount of GRN.

Advance Account Group:

Denotes the Account Group for Advance.

In case there is only one Advance Account Group defined, IMMS willl display it by default. Otherwise, click on the field to access a list of Account Groups and Sub Groups defined through Account Master Entry option. Select your desired Account Group or Sub Group from the list by clicking on it. Alternatively you can also enter the Account Group Code or Sub Group Code. Press <TAB>. The system will check whether the right Code has been entered or not.

Please note that only those Account Group and Sub Groups will be displayed/accepted that have been defined under 'ASSET' head with Group Type = 'Advance given to Creditors'.

PO Advance Paid:

Displays the Advance Amount if any that has already been paid to the Vendor against this Purchase Order through authorized Bank Transactions (Advance Payment) option. This information helps you to decide if you want to adjust Bill Amount against the Advance that has been given to the Vendor.

Please note that in case the Cheque through which advance was paid to the Vendor against the Purchase Order is returned for any reason, IMMS will not consider that payment.

UnAuth.Advance Till Date:

Displays the Advance Amount if any that has already been paid to the Vendor against this Purchase Order through un-authorized Bank Transactions (Advance Payment) option.

PO Advance Adj. in Past:

Displays the amount of advance that has been adjusted against this Purchase Order till date.

Bill Amt to be Credited for this PO:

Displays the Amount that has be paid to the Vendor against this Purchase Order through this Bill. You can not change it. It is calculated as the sum of 'Bill Amount' (from 'Transaction Details' tab) for all the GRN Items belonging to this Purchase Order.

Please note that in case the Bill is for 'Cutting GRN', this field will display the Amount that has be paid to the Vendor against this GRN through this Bill. You can not change it. It is calculated as the sum of 'Bill Amount' (from 'Transaction Details' tab) for all the GRN Items belonging to this GRN.

Round Off:

Click on the field. Now enter the digit up to which you want to Round Off the amount in 'Bill Amount After Adv/Ret/TDS' field.

PO Advance To Be Adjusted In This Bill:

In case some Advance amount has already been given to the Vendor, this field will enable you adjust the amount of that Advance against the current Bill Amount. The adjusted Advance Amount will be deducted from the final Bill Amount.

Click on the field. Enter the amount of Advance that has to be adjusted against the Bill. It should not be more than the Advance amount displayed in 'PO Advance Paid' field. It should also not be more that the current Bill Amount displayed in 'Bill Amt to be Credited for this PO' field.

Retention Account Group:

Denotes the Account Group for Retention.

Click on the field to access a list of Account Groups and Sub Groups defined through Account Master Entry option. Select your desired Account Group or Sub Group from the list by clicking on it. Alternatively you can also enter the Account Group Code or Sub Group Code. Press <TAB>. The system will check whether the right Code has been entered or not.

Please note that only those Account Group and Sub Groups will be displayed/accepted that have been defined under 'LIABILITY' head with Group Type = 'Retention from Creditors'.

Retention Amount (PO Wise):

This option allows you to retain some amount from the Bill Amount for any reasons. So the Retention Amount will be deducted from the final Bill Amount.

Click on the field. Enter the amount that has to be retained from the Bill Amount. It should not be more than the current Bill Amount displayed in 'Bill Amt to be Credited for this PO' field.

Please note here the Retention Amount mentioned in the Bill can be paid through Bank Transactions (Retention Payment) option.

TDS Category:

Specifies the TDS Category applicable.

Click on the field. A list of TDS Categories defined through TDS Category Master option is displayed. Select your choice from the list by clicking on it. Press <TAB>.

As a result a grid populated with the TDS Rate Codes applicable to the TDS Rate Structure that has been linked with the selected TDS Category will be displayed as follows -

Rate Amount:

In case of 'Percentage', the Rate Amount field in the grid is calculated automatically as Tax Value % of Current Bill Amount. In case of 'Value', the entered amount of tax is displayed.

Please note that the Amount on which the TDS is calculated depends upon the setting of flag 'In Bill Passing Entry / Service Bill Passing Entry, Calculate TDS on'

through Finance Policy option of Administrator Tools Module.

If 'On Basic Amount' is chosen, than IMMS will calculate TDS on the 'Current Bill Amount' - 'PO Advance To Be Adjusted In This Bill'

If 'With Tax Amount' is chosen, than IMMS will calculate TDS on the 'Current Bill Amount' + Tax Amount - 'PO Advance To Be Adjusted In This Bill'

Actual Amount:

IIMS allows to enter the 'At Actual' amount of tax through this field. By default the automatically calculated tax amount is displayed which you can change.

Click on 'Save' button to save the taxes or 'Cancel' button to discard.

TDS Amount:

Displays the total TDS Amount.

This field automatically calculates and displays the TDS Amount by adding up all the values in 'Actual Amount'. You can not change it here.

Bill Amount After Adv/Ret/TDS:

This is the final Bill Amount for the Cutting GRN/Purchase Order. You can not change it.

It is automatically calculated and displayed as follows -

Bill amount To Be Paid = Bill Amount - PO Advance to be Adjusted in this Bill - Retention Amount From This Bill - TDS From This Bill

TDS Apply On:

Automatically displays the 'Current Bill Amount' for your information. This is the amount on which TDS will be applied on. You can not change it.

While 'Adding',

click on ![]() button to continue further. As a result

you will be directed to the Narration section

button to continue further. As a result

you will be directed to the Narration section

In case of 'Edit', and 'View', you can directly click on the Narration section.

While 'Adding' a new Bill Passing Entry, enter Narration if any related to it.

In case of 'Edit' , and 'View', the Narration will be displayed automatically as per the selected Voucher Number. You can change it in 'Edit' mode.

Once you have entered all the information, click on 'Save' button to finally save it or 'Cancel' button to discard. The control will go back to the list.

| Please note that if HSN/SAC code has NOT been specified and the selected Vendor has a GST Number through Vendor Master Entry option of Purchase Module, IMMS will ask whether the user still wants to save the entry or discard it. Click on 'Yes' button to continue saving the voucher or 'No' to discard the action and enter HSN/SAC code first. |